Some of the best money I ever lost was when I sold Suntrust last year. I had bought it after Dad said it was probably ripe for a takeover that might increase its price. It had gone down lately, so I bought as many shares as I could with the money I had sitting around in my brokerage account: 19 shares at $77.06. That was in May 2006. It went up slowly but steadily and by the following year was at $90. My goal was to make 20%, so I wouldn't sell until it got to $93.28. Then it started going down. By October I was losing money. In November I decided to sell at a loss, $71.20. I say it was the best money I ever lost because it really started going down after that and every dollar it went down was a dollar I didn't lose.

Despite a steady fall, I decided the mortgage mess was played out and it was time to buy back in again at $47 on June 6. The fall accelerated. Less than 2 weeks later it was down 20%, which instead of selling can be a sign for me to buy more. This has worked well for me with Oracle and Microsoft stock. Then I sell when things go back up and I usually can show a loss on paper by saying I sold the original higher priced shares. Eventually I will have a bigger gain, but it would hopefully be long term at that point. So I bought some more at $36.98. About a month later it fell drastically again and I was down another 20%. Time to buy more, but at this point I'm getting nervous. I bought some more at $29.00 just this week.

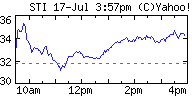

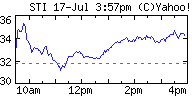

It went down a little more, to $25.60, but not enough to buy more (I decided I didn't want any more anyway). Yesterday it sprang back to life very quickly, up 15%. This morning it opened with another big gain. My newest shares had a target sell price of $35.50, so I entered an order to sell at that price. At the time the shares were selling in the high 34's, so it wasn't a lock that the limit would be met and the order would be executed. I checked back about an hour later anyway. I noticed I had too many shares and that my order had gone through at only $34.66. In fact, what I had done earlier was to enter a buy order at $35.50 which had executed immediately and instead of dumping some of this stuff at a better price than 2 days ago, I had just bought my 4th batch. Don't worry, it gets worse.

By this time, calmer heads had prevailed and the stock was on its way down. I quickly calculated the price I would need to sell the shares just to break even (and pay for the $7 commission twice): $35.30. So I put in a sell order at that price, but by this time the shares were down to $33. It gets worse. Around 11 AM, Suntrust was actually below yesterday's closing price of $31.83. Now that mess up was costing me $76. I hung tough, hoping for the best.

It got better. For some reason it was off to the races again and the stock climbed up to 34 again before closing at $34.58. I would have sold at that price and taken the small loss but the network crashed at about 3:30 and I wasn't up and running again until about 4:30, after the market closed. So I never sold the shares, but I hope that I can tomorrow. There were some earnings reports that didn't meet analyst expectations, so tomorrow could be rough, plus with the stock up over 20% in two days, the chances of it going down tomorrow are pretty high.

The lesson here is to be careful. I put some blame on the broker, Scottrade, and their website since it seems like they could warn you that you are entering a limit order that will execute immediately, but they can't make the system idiot-proof either. And I was an idiot today. Also I have to question myself for buying Suntrust again. I think part of it was a desire to buy the stock back for less than I had sold it for and really I should have been happy sitting it out.