Recently in Money Category

Clark Howard recommended the website creditcardtuneup.com where you can plug in your spending patterns, and the site will point you in the direction of the best rewards program. I did this almost three years ago and decided to switch our "first card out of wallet" from Discover Card to American Express Blue. At the time I did not realize I could only get cash back annually, unlike Discover who allows you to get cash back as you go. But, the estimated $1,000 cash back by the estimator has proven to pay off.

I just ran our spending patterns (which are still largely grocery, department store, and gas) through the tune up again and got the results below. Where is American Express Blue? It didn't even show up in the list. (I'm just showing above $500 payback below.) I wonder how much of this is driven by advertising campaigns paid to Credit Card Tune-up or referral fees? Perhaps Amex is not pushing Blue right now, because it has certainly continued to pay back. Hmmmm.....

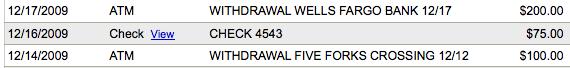

It has been a year since Wells Fargo acquired Wachovia. This showed up on my Wachovia statement for the first time....

It went from 14 cents to 17 cents today. Whoo hooo!!!! The market is coming back!!!!

![]()

(We're rich.)

Looks like Ted (and others) may be looking for a new credit card. Clark Howard recommended the website creditcardtuneup.com where you can plug in your spending patterns, and the site will point you in the direction of the best rewards program for you. Kathy and I have always used Discover as our primary card because it pays you back in cash. But after running through the site, I found that Discover ranked far below other options. For us, the American Express Blue ranked at the top. I think this is because we spend so much on groceries and at department stores. It also pays cash back. (I'm not interested in trying to figure out how to maximize sky miles, gift cards, etc. Too complicated. Cash please.)

I signed up on the spot, and now Kathy and my primary card is American Express Blue. It has a smart chip in it, but no one makes use of that (yet.) After two decades with Discover our balances suddenly went to near zero.

With Wachovia, I have never been clear what would happen to an on-line bill pay check if the recipient did not cash it. This mainly had to do with the paper checks that are sent to people or small businesses rather than corporations... corporate bill pays tend to be electronic.

At Wachovia, my account would be deducted right away, and I had no way of knowing if the person had received or deposited the check. I didn't like that.

At HSBCdirect.com, the "laser checks" act more like a real check. It only comes out of my account when the recipient deposits the check, and I see an image of their endorsement on the back. So I like HSBC's on-line bill pay better than Wachovia's.

Of course, none of this is good news for my company.

Letter attached.

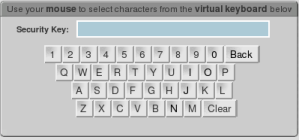

I'm glad Ted wrote this timely post, Stupid Site-Key, about ING and their excessive security measures. You can tell 2006 is coming to an end because January 2007 is the deadline for banks to add extra security for on-line banking.

ETrade added keyfobs over a year ago. Kathy and I got two free keyfobs, and while it made it more difficult to access, I actually appreciate the security given that is where we store most of our investments.

ETrade added keyfobs over a year ago. Kathy and I got two free keyfobs, and while it made it more difficult to access, I actually appreciate the security given that is where we store most of our investments.

HSBC added a second password that has to be "clicked" in using a little on-line keyboard. In this way, crooks cannot use a "keylogger" to capture what you are typing. I didn't mind this step so much, but then they decided last month that my passwords were not complicated enough and they quit working. There was no explanation of this until I called in and talked to a very nice person on the other end of the phone. However, the nice person had to ask me a lot of personal questions so that he was convinced I was who I said I was. I agree with Ted I don't like giving out this personal information and will start making up answers (that I can remember.) I store hints to my passwords in notepad.yahoo.com (Mom... you may want to do the same.) I store lots of things in notepad.yahoo.com. Very useful because I can get to my notes and tips from anywhere on the internet.

HSBC added a second password that has to be "clicked" in using a little on-line keyboard. In this way, crooks cannot use a "keylogger" to capture what you are typing. I didn't mind this step so much, but then they decided last month that my passwords were not complicated enough and they quit working. There was no explanation of this until I called in and talked to a very nice person on the other end of the phone. However, the nice person had to ask me a lot of personal questions so that he was convinced I was who I said I was. I agree with Ted I don't like giving out this personal information and will start making up answers (that I can remember.) I store hints to my passwords in notepad.yahoo.com (Mom... you may want to do the same.) I store lots of things in notepad.yahoo.com. Very useful because I can get to my notes and tips from anywhere on the internet.

But what really made me mad about HSBC was that they decided to cut off automated access using Quicken. I use Quicken to go gather all transactions from my various checking, savings, credit card, and investment accounts. I will not even open an account unless it supports Quicken. However, HSBC has decided this is not secure because it relies on Intuit (Quicken) security and not their own. Now I have to log in and download a special file (qfx) to import my transactions. Still saves keying in the transactions, but it is more of a hassle.

So I went off looking to move my money to ING. But they have also turned off automatic access from Quicken. And with Ted's post, I think I'll stay away from ING and just stick with HSBC.

By the way, it is going to get stranger as you start getting asked questions like "what was the square footage of the house you owned in 1986." This happened to me recently. I had no idea, but the bank did because they were using a service that combs public records for "out of wallet" information. They call it out of wallet, because it is information you are not likely to have in your stolen wallet.

In this case, it is good to have a spouse who remembers square footages.

[Written on Dell 840c Laptop running Fedora 5 with FireFox for Linux. Used built in screenshot and GIMP graphic editor to create graphics.]

I'm inclined to choose the Prius, Jetta, or Mini Cooper. Perhaps a Civic to be like Ted and Nicole.

Smartmoney.com: Consumer Reports: The most fuel-efficient cars that CR has tested

The highest gasoline charge (for a car) I've ever purchased:

The fact it was at High Point Citco is either an example of irony, mockery, or just coincidence. Not sure which.

Danny got a checking account over a year ago. When a new client came out with a series of fun checks, Danny wanted to get the John Deere checks. He had not really had a reason to have checks, and really won't need them until school.

I ordered them over the web for him and had to guess at the layout of numbers at the bottom, since he never had checks before. We did a test. It worked. He's now ready to start giving his money to Spring Hill. (And yes, I refunded the $5 test to him but I used electronic funds transfer. Much easier.)

Clark Howard has a collection of tips, most of them against using debit cards (Wachovia called them check cards.) With credti cards there are all kinds of rules and regulations that protect you in case of fraud or merchant error. A simple phone call will typically clear up any problem.

Debit cards do not have the same level of protection. And because they can be used without a PIN number, you can have a lot more hassle with a stolen debit card than a stolen credit card.

Wachovia keeps sending us "Visa Check Cards." I call them and tell them we do not want them. We just want an ATM card. Clarke's June 4 post suggest I may not be able to get away with this much longer.